One way of keeping track of your household finances is to develop a budget. This is a list of all your expenses and the estimated cost of each expense. Developing and following a budget should ensure you do not spend more than you earn. A budget can be planned on a weekly, fortnightly or

monthly basis. Usually it is a good idea to budget according to the timing of your income. For example, if you are paid weekly, compile a weekly budget. A budget should list all fixed expenses (those that you cannot change; for example, rent) and all variable expenses (those that may vary over time; for example, food and electricity).

Using all the information that we have collected through out this process we will attempt to create a budget for 6 months of 'being independent' living out of home.

Tuesday, May 5, 2009

Expenditure - Ongoing Purchases - What Will I Need Living Away From Home?

When considering your food and grocery requirements, think about the everyday items as well as those items that always seem to be there like washing powder or shampoo. Using the list that I have drafted for you, we will be visiting Salamander Centre to give us an indication of how much money we will need each week for groceries.

Credit Cards

When you have a credit card, you are given a credit limit and are allowed to spend up to that limit. The company that gives you the credit card (usually a bank) pays for your goods and services and then sends you a bill each month, which shows your purchases and minimum repayments. Credit cards are a flexible and convenient way to spend money however they are quite expensive due to the high rates of interest that are charged. Credit cards have gradually become the country’s favourite way to pay. At present, Australia’s 10 million credit card users spend about $4.50 of every $10 spent in the retail sector, including all shopping and most hospitality and leisure industries.

Borrowing Money

People borrow money because they wish to spend more money than they have at the moment. They do not want to put off their spending until the future when prices may have risen. Instead, they want to purchase their need or want now. Most people in Australia will have to borrow money to purchase major items. When you borrow money you are in debt. Being in debt is not a problem as long as you remain in control of the debt; that is, you are able to make the repayments. There is a price attached to borrowing. The money that is borrowed is called the loan principal. Not only will you have to repay the principal amount but also the interest. When you borrow money, the main cost you need to pay is the interest charged by the lending institution (typically a bank). The interest charged on the loan principal will depend on the interest rate per annum, the duration of the loan, and the amount of the loan repaid each month. Different loans have different interest rates. Interest rates can be either fixed or variable. A fixed interest rate means the rate does not change for the duration of the loan. A variable rate,

on the other hand, means that the lender can change the interest rate at any time during the loan.

There are four important steps to take when you are deciding whether to borrow money.

1. Understand that you will be getting yourself into debt. You will need to pay the principal plus the interest charges. Find out what type of security, if any, is required.

2. Find out how much the loan is in total. The loan is made up of:

• the principal

• the interest charge

• any additional costs, such as fees, stamp duty and government charges.

•Find out the annual percentage rate of interest and whether it is a fixed or variable interest rate.

3. Work out your repayment amounts:

• how much per repayment

• how many repayments in total

• when each repayment is due.

•Find out whether you can repay the loan over a shorter period. If you can, watch out for penalty

rates. Can you afford the repayments?

4. Understand what the consequences will be if you can’t make the repayments

on the other hand, means that the lender can change the interest rate at any time during the loan.

There are four important steps to take when you are deciding whether to borrow money.

1. Understand that you will be getting yourself into debt. You will need to pay the principal plus the interest charges. Find out what type of security, if any, is required.

2. Find out how much the loan is in total. The loan is made up of:

• the principal

• the interest charge

• any additional costs, such as fees, stamp duty and government charges.

•Find out the annual percentage rate of interest and whether it is a fixed or variable interest rate.

3. Work out your repayment amounts:

• how much per repayment

• how many repayments in total

• when each repayment is due.

•Find out whether you can repay the loan over a shorter period. If you can, watch out for penalty

rates. Can you afford the repayments?

4. Understand what the consequences will be if you can’t make the repayments

Expenditure - Major Purchases - What Will I Need Living Away From Home?

When you move out of home it is inevitable that you will need to purchase some major items.

Using the websites listed below come up with approximate prices for each of the products outlined in the 'Major Purchases' Table. This will give us an indication of how much money we need in order to purchase the major items required for moving out.

Harvey Norman

The Good Guys

Fantastic Furniture

Using the websites listed below come up with approximate prices for each of the products outlined in the 'Major Purchases' Table. This will give us an indication of how much money we need in order to purchase the major items required for moving out.

Harvey Norman

The Good Guys

Fantastic Furniture

The Process of Arranging A Lease

Once you have found somewhere to rent you will normally be required to sign a lease agreement, known as a residential tenancy agreement. This is a written legal agreement (contract) between the person who rents the house or apartment (the tenant), and the person who owns it (the landlord). Landlords are usually represented by a real estate agent. By signing a lease, you agree to look after the property and to pay a certain amount of rent for a set period of time (usually a minimum of six months) and at specified intervals (such as weekly or fortnightly). The lease protects you as the tenant because the landlord usually cannot raise the rent for the period of the lease or force you to leave unless the landlord gives you notice or you

have breached, or broken, the agreement. There are, of course, penalties if you don’t keep to this agreement. For example, you may incur a penalty if you do any of the following:

• fail to pay the rent

• leave before the lease period is finished

• do not give notice before you leave.

Often these penalties involve the loss of part, or all, of your bond.

On signing the lease you will be required to pay a refundable bond (usually the equivalent of four weeks rent) which covers the cost of any damage or breakages that you may cause while you are renting the property. Provided you look after the property carefully and do not break any of the other conditions of the lease, the bond will be returned when you move out of the property.

When you sign up for the accommodation, you will be given a property condition report. This is a checklist of the conditions of fixtures (such as the stove, walls and floors) in each room in the house or apartment. It will be completed by the landlord or real estate agent before you move in. You should also complete the condition report before you move in. If you wait until the furniture

is in place, you might not notice existing marks and stains on the walls and carpets. When you move out, the landlord or real estate agent compares the condition report against the condition of the property. Any marks or breakages not on the original condition report will be seen as damage you caused, so it is important to take great care when completing the report. You can insist on being present when periodic and final inspections are carried out so that no misunderstandings occur. Before you move in you must also pay some rent in advance - usually two weeks. The lease entitles the owner or agent to inspect the property every three months and before the bond is returned when you want to move out. The owner or agent will deduct from your bond the cost of any repairs or maintenance; for example, steamcleaning the carpet if it is stained and you didn’t have it cleaned before you moved out. If you decide to leave the place before the lease is up, or if you do not pay the rent, the agent will normally take what you owe out of the bond and you will only get back what is left, if anything. If the bond does not cover what you owe and you do not pay the difference you can be placed on a blacklist, or database, of bad tenants. This is very serious because most agents have access to this database, and if blacklisted, you will find it very difficult to rent another property.

Before a tenant enters into a tenancy agreement (lease) or moves in to a residential property they must be given the following documents by the landlord or the landlord's agent:

have breached, or broken, the agreement. There are, of course, penalties if you don’t keep to this agreement. For example, you may incur a penalty if you do any of the following:

• fail to pay the rent

• leave before the lease period is finished

• do not give notice before you leave.

Often these penalties involve the loss of part, or all, of your bond.

On signing the lease you will be required to pay a refundable bond (usually the equivalent of four weeks rent) which covers the cost of any damage or breakages that you may cause while you are renting the property. Provided you look after the property carefully and do not break any of the other conditions of the lease, the bond will be returned when you move out of the property.

When you sign up for the accommodation, you will be given a property condition report. This is a checklist of the conditions of fixtures (such as the stove, walls and floors) in each room in the house or apartment. It will be completed by the landlord or real estate agent before you move in. You should also complete the condition report before you move in. If you wait until the furniture

is in place, you might not notice existing marks and stains on the walls and carpets. When you move out, the landlord or real estate agent compares the condition report against the condition of the property. Any marks or breakages not on the original condition report will be seen as damage you caused, so it is important to take great care when completing the report. You can insist on being present when periodic and final inspections are carried out so that no misunderstandings occur. Before you move in you must also pay some rent in advance - usually two weeks. The lease entitles the owner or agent to inspect the property every three months and before the bond is returned when you want to move out. The owner or agent will deduct from your bond the cost of any repairs or maintenance; for example, steamcleaning the carpet if it is stained and you didn’t have it cleaned before you moved out. If you decide to leave the place before the lease is up, or if you do not pay the rent, the agent will normally take what you owe out of the bond and you will only get back what is left, if anything. If the bond does not cover what you owe and you do not pay the difference you can be placed on a blacklist, or database, of bad tenants. This is very serious because most agents have access to this database, and if blacklisted, you will find it very difficult to rent another property.

Before a tenant enters into a tenancy agreement (lease) or moves in to a residential property they must be given the following documents by the landlord or the landlord's agent:

- a copy of the proposed tenancy agreement (filled out by the landlord or agent where appropriate in the spaces provided) which comes in two parts:

- the terms of the agreement

- a report on the condition of the property (called the condition report)

- a written statement of the costs payable by the tenant on signing the agreement

- a copy of the The Renting Guide

The tenant must be given time to read and understand the terms of the tenancy agreement before being asked to sign it.

Finding a Suitable Place to Live

There are many ways to find a suitable place to live. The most common of these are explained below:

• Newspaper advertisements - Advertisements for renting, sharing and private board can be found in the classifieds section of most newspapers, either in printed form or on their websites.

• Real estate agents - Property managers in real estate agencies can advise you on what is available in your price range and preferred locations. You may phone them or visit them in person. Look at the advertisements in real estate agency windows or visit their websites. ‘For rent’ or ‘For lease’ signs on properties will also help you to find a fl at or house.

• Community noticeboards - Many shopping centres, community centres, universities and colleges have noticeboards where advertisements for accommodation can be placed and read.

• Word of mouth - Informal networks that develop, for example, among friends, workmates, students and teammates are a good way of exchanging information about needing or having accommodation to rent.

Access the real estate agents in the Nelson Bay area to find rental accommodation. You must provide a short list of five (5) examples of appropriate places for you to live. From your short list you are to select the place you wish to live.

Nelson Bay Real Estate Agents:

Domain

Realestate.com.au

PRD Nationwide

Ray White

Raine and Horne

Nelson Bay Real Estate

Century 21

First National

Robinson Property

O'meara Property

LJ Hooker

Quest Property Services

Newcastle Real Agents:

PRD Nationwide

Raine Horne

Domain

Real Estate.com

Ray White

Robinson Property

Century 21

LJ Hooker

First National

• Newspaper advertisements - Advertisements for renting, sharing and private board can be found in the classifieds section of most newspapers, either in printed form or on their websites.

• Real estate agents - Property managers in real estate agencies can advise you on what is available in your price range and preferred locations. You may phone them or visit them in person. Look at the advertisements in real estate agency windows or visit their websites. ‘For rent’ or ‘For lease’ signs on properties will also help you to find a fl at or house.

• Community noticeboards - Many shopping centres, community centres, universities and colleges have noticeboards where advertisements for accommodation can be placed and read.

• Word of mouth - Informal networks that develop, for example, among friends, workmates, students and teammates are a good way of exchanging information about needing or having accommodation to rent.

Access the real estate agents in the Nelson Bay area to find rental accommodation. You must provide a short list of five (5) examples of appropriate places for you to live. From your short list you are to select the place you wish to live.

Nelson Bay Real Estate Agents:

Domain

Realestate.com.au

PRD Nationwide

Ray White

Raine and Horne

Nelson Bay Real Estate

Century 21

First National

Robinson Property

O'meara Property

LJ Hooker

Quest Property Services

Newcastle Real Agents:

PRD Nationwide

Raine Horne

Domain

Real Estate.com

Ray White

Robinson Property

Century 21

LJ Hooker

First National

Major Considerations When Searching For Accommodation

Where you choose to live when you leave home will depend on a number of factors. A major consideration in finding accommodation is how much you can afford to spend. Another important factor is location. This will be infl uenced by where you are working or studying. The closer you are to where you need to go each day, the easier it will be for you. It will, for example, minimise the cost and time necessary to spend on transport. On the other hand, if the area where you work or study is expensive, it may be better to live in a cheaper area and spend a little more on transport. When you rent a home in NSW and become a 'renter' or a 'tenant', knowing your rights and responsibilities will help you avoid or resolve differences you may have with your landlord, real estate agent, house-mates or neighbours. The Office of Fair Trading manages the laws that govern your rights and responsibilities as a renter and can give you information to help you understand what these laws mean for you. It is illegal in NSW for landlords and real estate agents to discriminate on the basis of race, sex, marital status, disability, age (which is a big one from out point of view) and sexuality.

Some of the major considerations when searching for accommodation include:

• Bonds - This is an amount of money (usually equivalent to four weeks rent) that must be paid by the tenant to the real estate agent in case the tenant damages the property or cannot pay the rent.

• Advance rent - A tenant is usually expected to pay two weeks rent in advance.

• Deposits and connection fees - When someone moves into a new place, they must pay to have the telephone, gas and electricity connected, which can amount to hundreds of dollars. These services are known as utilities.

• Furniture - If the property is unfurnished, it may be necessary to buy large items (such as a fridge and a bed) as well as everyday items (such as crockery and bed linen).

Before you move in

Some of the major considerations when searching for accommodation include:

• Bonds - This is an amount of money (usually equivalent to four weeks rent) that must be paid by the tenant to the real estate agent in case the tenant damages the property or cannot pay the rent.

• Advance rent - A tenant is usually expected to pay two weeks rent in advance.

• Deposits and connection fees - When someone moves into a new place, they must pay to have the telephone, gas and electricity connected, which can amount to hundreds of dollars. These services are known as utilities.

• Furniture - If the property is unfurnished, it may be necessary to buy large items (such as a fridge and a bed) as well as everyday items (such as crockery and bed linen).

Before you move in

Income

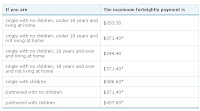

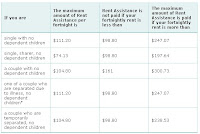

For the purpose of this task we will assume that everyone is eligible for Centrelink independent living away from home allowance (youth allowance)as well as rent assistance. We will assume that you all have a part time job which you work on weekends that pays you $100 per week ($200 per fortnight).

Access the Centrelink website by using the links below. Ascertain the assistance you would be entitled to on youth allowance. You will also need to find out the amount of rent assistance you would be eligible for as you will be living away from home. You should present this in a table form similar to the table Mr Cronin has given you.

Youth Allowance

Rent Assistance

Youth Allowance

Major Issues Involved With Independent Living

The following are the major issues associated with independent living:

• Am I old enough to leave home?

- In NSW there is no law setting an age at which a person can leave home. If you have a safe place to go and you can support yourself financially you can normally leave at 16.

• Am I mature enough to leave home?

• Can I afford to leave home?

- How much will it cost?

- Where will the money come from?

• Where am I going to live?

- How do I go about getting accommodation?

- Will I share with anyone?

• How will I look after myself?

- Practical skills such as cooking, cleaning, budgeting

• Who can I turn to if I need help?

- Government, religious and community based organisations

Subscribe to:

Posts (Atom)